Our Approach

Every client brings a story. Whatever your story, our job is to come alongside to understand your situation and where you want your story to end. Open, honest conversations establish a freedom to discover what financial flourishing means to you and your loved ones. Then we help you f as flourish as safely as possible.

Every client is a partner. You have the right to expect our relationship and the plans we design to make sense to you. We encourage you to be assertive and inquisitive. Questions and discussion lead to a better understanding of investments and financial planning. As we work together to determine the best path forward, open-mindedness and dialogue lead to innovative and meaningful solutions. Educating you about the art and science of financial planning, investing, debt management, retirement decisions and so much more empowers you to flourish personally and financially.

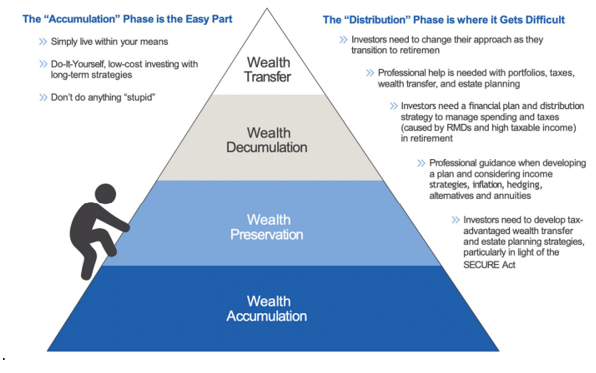

We help you retire successfully and then stay successfully retired. You started, we get you to the finish.

Core Principles

Our relationships are grounded in our belief that humanity was created with inherent dignity, value, and worth. We strive to: respect the value and freedom of all people, demonstrate a concern for justice and peace, promote family and community, exhibit responsible management practices, and practice environmental stewardship.

All behavior is belief driven. We believe in honoring our clients by providing ongoing education, excellent service, and empathetic ears through the highs and lows of life. We preserve your privacy.

All our planners hold the CERTIFIED FINANCIAL PLANNER™ (CFP®) designation or are working towards it and are members of the Financial Planning Association. We also serve our communities through volunteering in our chosen non-profit organizations.

We utilize fee-only, independent advice unique to your circumstances and goals. This is the most transparent, respectful way for us to serve you.

Fees

Fees are negotiable under certain circumstances. Fees are billed in arrears on a quarterly basis. Minimum fee is $500 annually. See Disclosure Brochure for full details.

Asset Management

- 1% on first $500,000 then

- 0.75% from $500,001 to $1,000,000 then

- 0.5% from $1,000,001 to $2,000,000

- 0.4% from $2,000,001 to $3,000,000

- 0.3% from $3,000,001 to $5,000,000

- 0.2% above $5,000,000

- Flat fees available.

Financial Plan Writing

- $800 to $6,000 (depending on complexity)